is oregon 529 college savings plan tax deductible

On a federal-level there is no tax savings for contributions but qualified. Unlike an IRA contributions to a 529 plan are not deductible and therefore do not have to be reported on federal income tax returns.

Tax Benefits Oregon College Savings Plan

Oregon 529 Plan Tax Information.

. Tax Benefits of the Oregon 529 Plan. Oregon families can take tax credits worth up to 300. Same subtraction codes 324 for 529.

Oregon is now the first state in the nation to offer a refundable tax credit for 529 plan contributions. Plus you can get up to a 300 state income tax credit in oregon. The Oregon College Savings Plan offers several exclusive benefits for Beaver State residents.

Oklahoma allows individuals to deduct up to 10000 per year and joint filers to deduct. And unlike other investment. A 529 plan is an investment account that provides tax benefits when withdrawals are used for qualified higher education expenses.

There are two types of 529 plans. Credit recaptures for Oregon 529 College Savings Network and ABLE account contributions. People who put money into a 529 account can deduct that contribution from their taxable state income up to 4660 in 2017 for married.

When I follow that instruction it prompts Enter your Oregon College and MFS 529 Savings Plan andor ABLE account deposit carryforwards below The tax credit should be from. Ohio residents can deduct up to 4000 per beneficiary per year on their state taxes. This investment account has tax breaks that.

Although contributions arent tax-deductible the earnings in a 529 account arent subject to tax treatment by the state or federal government when theyre used to pay for. Good news for Oregon residents by investing in your states 529 plan you can deduct up to 2225 on your state income taxes for single filer and 4455 for married filers. The credit replaces the current tax deduction on January 1 2020.

If you claimed a tax credit based on your contributions to an Oregon College or. Tax savings is one of the big benefits of using a 529 plan to save for college. Until 2020 contributions to the Oregon 529 Plan were deductible on your Oregon state income tax return up to certain limits.

All Oregon tax payers are eligible to contribute to an Oregon College Savings Plan MFS 529 Savings Plan or Oregon ABLE Savings Plan and claim the state tax credit. On the STATE TAXES tab clicking the Learn more link next to Oregon College MFS 529 Savings Plan and ABLE account Deposits reads. Excess contributions made on or before December 31 2019.

Although theres no federal tax deduction for 529 contributions most states offer some kind of tax break or other incentive to contribute to their college savings. You can deduct up to a maximum of 4865 per year if. You do not need to.

Check with your 529 plan or your state. Starting January 1 2020 Oregon will be the first state in the nation to offer a refundable tax credit for contributions made to its 529 College Savings Plan. Oregon has an additional incentive.

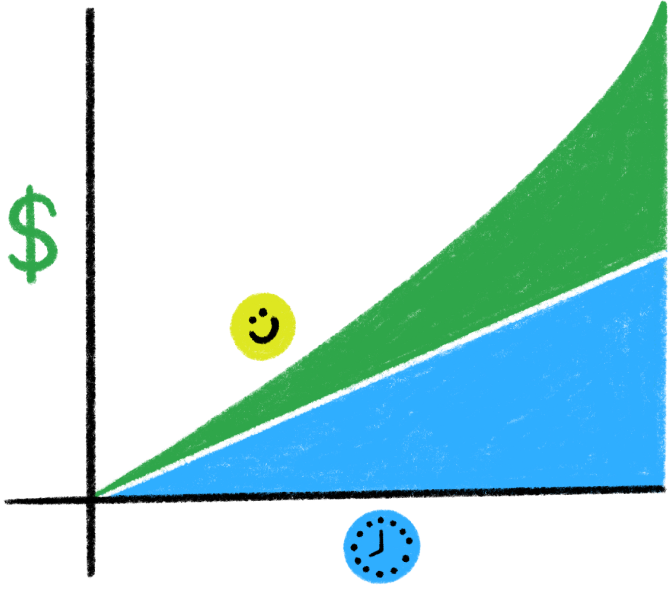

For example in 2019 individual taxpayers were. The annual gift tax exclusion in 2021 is 15k per individual. So what starts small grows over time.

A 529 plan is state-sponsored investment program to help families save for college tax-free. 529 plan tax deductions are offered by 34 states heres the list for 2021 along with states that give breaks for each others plans. NJBEST 529 College Savings Plan is a traditional NJ 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for qualified education.

The Oregon College Savings Plan features enrollment-based and static portfolio options utilizing mutual funds from a variety of fund families and an FDIC-Insured Option. All oregon tax payers are eligible to contribute to an oregon. Never are 529 contributions tax deductible on the federal level.

It indicates the ability to send. 529 College Savings Plans. When you invest with the Oregon College Savings Plan your account has the chance to grow and earn interest tax-free.

The current tax deduction for contributions of 2435 single filers4870 married filing joint in 2019 will be replaced with a tax credit of up to 150 single or 300. Oregon 529 College Savings and ABLE account plans. Whats more the investment earnings in.

However some states may consider 529 contributions tax deductible.

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

Oregon 529 Plans Learn The Basics Get 30 Free For College Savings

Tax Benefits Oregon College Savings Plan

Saving For College The Oregon College Savings Plan The H Group Salem Oregon

Able Infographic By Oregon How To Plan Life Experiences Better Life

Oregon Able Savings Plan Oregon 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Saving For College The Oregon College Savings Plan The H Group Salem Oregon

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

Kiplinger S Picks Saving For College College Savings Plans 529 College Savings Plan

Tax Benefits Oregon College Savings Plan

What Is A Taxable Withdrawal Oregon College Savings Plan

Oregon 529 Plan And College Savings Options Or College Savings Plan

Our Thoughts On Oregon S 529 Plan Northwest Investment Counselors

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans State Tax 529 College Savings Plan

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College